Tired of chasing vendors for W-9s, deciphering messy handwriting, and worrying about compliance penalties? I get it. A vendor tax form collection portal is your way out of that mess. Think of it as a central hub—a smart, automated software solution built to take these headaches away from your accounts payable team. It completely streamlines how you request, check, and store crucial tax documents like W-9s and W-8s.

Ending Paperwork Chaos with a Vendor Tax Portal

For most accounting teams, the old way of handling vendor tax forms is a constant source of friction. You know the drill: endless email chains, tedious manual data entry, and overflowing filing cabinets. This approach isn't just inefficient; it's packed with risk. A single typo on a W-9 or a missed deadline can cascade into incorrect 1099 filings and attract some painful IRS penalties.

Now, imagine swapping that chaos for a system that actually works for you, not against you. A vendor tax form collection portal turns this reactive, stressful chore into a smooth, automated workflow. Instead of manually navigating complex tax rules and hounding vendors for paperwork, the portal handles the entire journey from start to finish.

From Manual Burden to Automated Efficiency

At its heart, a vendor tax portal is designed to make every step of the compliance process simpler. It doesn't just collect documents; it makes sure they're correct from the moment you receive them. This leap from manual work to automation has a huge impact on how your business runs.

Here’s how it breaks down:

- Ends Repetitive Tasks: The portal sends out automated requests and reminders, freeing your team from the endless loop of follow-up emails and phone calls.

- Slashes Human Error: By validating information like Taxpayer Identification Numbers (TINs) in real-time, it catches mistakes instantly. This happens long before they have a chance to become a real compliance problem.

- Boosts Security: Let's face it, email attachments and paper files aren't secure. A portal stores sensitive vendor information in a secure, encrypted digital vault.

- Builds a Clear Audit Trail: Every single action is time-stamped and logged. If an auditor ever comes knocking, you’ll have a clear, defensible record of all your compliance efforts.

A vendor tax form collection portal is fundamentally about turning a major administrative headache into a controlled, predictable, and efficient process. It gives your team back valuable time and, maybe more importantly, provides some much-needed peace of mind.

While this portal zeroes in on vendor tax compliance, the bigger challenge of taming financial paperwork is a universal business struggle. Exploring general strategies for organizing business receipts and simplifying financial management can offer a broader perspective on getting your financial house in order. By embracing these kinds of digital tools, you can finally end the paper chase and focus on what really matters—growing your business.

How a Vendor Tax Form Collection Portal Actually Works

So, how does one of these portals actually get the job done?

At its heart, a vendor tax form collection portal is a secure, central online space where your vendors can submit their required tax forms, like the W-9 or W-8 series. But don't just think of it as a digital filing cabinet. It’s more like a smart, automated compliance expert for your accounts payable team.

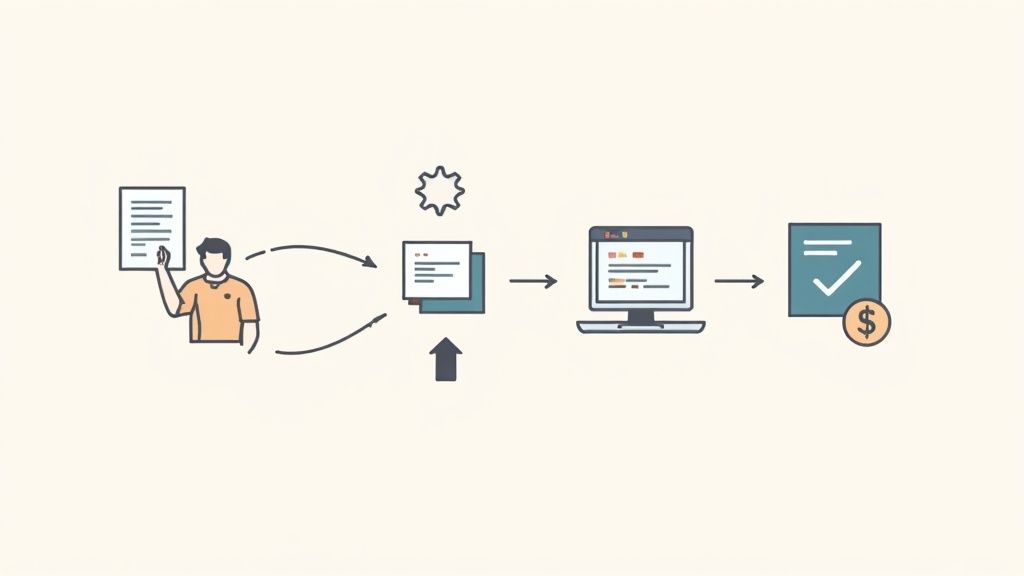

The portal handles the entire journey, from asking the vendor for their info to securely storing the finished form. It sends out professional, branded requests, guides each vendor to the right form for their situation, and even checks their data for errors on the spot. This is a world away from the old manual methods.

The Automated Workflow Step-by-Step

Let's walk through a real-world scenario. Say you're bringing on a new contractor. Instead of your AP team digging up a PDF W-9 and emailing it back and forth, the portal takes over. The whole process is designed to be painless for the vendor and practically foolproof for you.

-

Vendor Invitation and Onboarding: You start by plugging the vendor's basic contact details into the system. The portal then automatically sends them a secure, branded invitation to their own self-service page. Right away, this looks more professional and organized.

-

Guided Form Selection: This is a crucial step. The vendor answers a couple of simple questions, like, "Are you a U.S. person or business?" Based on how they answer, the system instantly serves up the correct form—no guesswork needed. A U.S.-based freelancer gets a W-9, while a foreign entity gets the right W-8 form.

-

Real-Time Data Validation: Here's where the real magic happens. As the vendor types in their information, the portal is actively checking it for mistakes. The most important check? It validates the Taxpayer Identification Number (TIN) against official databases, like the IRS TIN Matching system.

This single feature prevents one of the biggest—and most expensive—headaches in accounts payable. It flags a mismatched TIN or an incomplete address before the vendor can even hit "submit," forcing them to correct it on the spot. This stops a whole chain of problems down the line, from payment delays to stressful B-Notices from the IRS.

Beyond Collection: The Full Compliance Lifecycle

A good portal doesn't just stop once the form is collected. It's built to manage that vendor's compliance status over the long haul, keeping you audit-ready and up-to-date.

The system securely stores every document, creating a clean audit trail you can pull up anytime. Every single action—from the first email request to the final, validated form—is logged and timestamped. When auditors come knocking, this proves you have a consistent and defensible process.

The system also keeps an eye on form expiration dates. This is especially critical for international vendors.

For foreign vendors, the equivalent documents are Forms W-8BEN or W-8BEN-E; these forms certify foreign status and are essential in determining withholding tax obligations. The emphasis on early and ongoing collection of these tax forms highlights the critical role vendor tax form portals play in automating compliance workflows within payables and accounting departments, ensuring adherence to IRS mandates and minimizing fraud risks. You can read more about the importance of collecting these forms on Tipalti.com.

Instead of someone tracking expiration dates on a spreadsheet, the portal automatically sends reminders to vendors before their forms expire. This ensures you always have current documents on file without any manual effort. It turns a tedious, error-prone chore into a smooth, secure part of your operations. When you're looking to simplify your processes, it's also worth reading our guide on document collection software to understand the broader benefits of automation.

Manual Tax Form Collection vs Automated Portal

To truly see the difference, it helps to compare the old way of doing things with the modern, portal-based approach. The contrast in efficiency, accuracy, and security is stark.

| Feature | Manual Process | Portal-Based Process |

|---|---|---|

| Initiation | AP team emails a blank PDF form to the vendor. | System sends a branded, secure link to a self-service portal. |

| Form Selection | Vendor must know which form (W-9, W-8BEN, etc.) to use. | System guides the vendor to the correct form with simple questions. |

| Data Entry | Vendor fills out the PDF; prone to typos, illegible handwriting. | Vendor completes a digital form with clear, required fields. |

| Validation | Errors (like a wrong TIN) are only caught later, often after payment. | TIN is validated against IRS database in real-time before submission. |

| Submission | Vendor emails the form back, creating a security risk. | Form is submitted and stored in a secure, encrypted environment. |

| Tracking & Storage | Forms are saved in folders, spreadsheets; easy to misplace. | All forms are stored centrally with a complete, time-stamped audit trail. |

| Renewals | Someone must manually track expiration dates and request new forms. | System automatically monitors expirations and sends renewal reminders. |

As you can see, a portal doesn't just digitize the process—it completely redesigns it for accuracy and efficiency, freeing up your team to focus on more strategic work.

The Rise of Global Tax Compliance Technology

The idea of a modern vendor tax form portal didn’t just appear out of thin air. It grew from a very real, and often painful, problem that businesses everywhere were facing as tax laws became more complex and global.

Not too long ago, handling vendor tax compliance was a complete mess. Accounts payable teams were stuck in an endless loop of emailing PDFs, trying to read messy handwriting, and keeping track of everything in giant, unwieldy spreadsheets. It was a system built on good intentions and a whole lot of follow-up calls.

The Forces Driving Change

As businesses started expanding internationally and the gig economy took off, this old-school manual approach began to fall apart. The sheer volume and complexity of managing different tax forms for vendors in different countries just wasn't sustainable. Two major shifts really pushed things to a breaking point.

First, globalization meant that even smaller companies found themselves working with international contractors and suppliers. This opened up a whole new can of worms with forms like the W-8BEN and W-8BEN-E, each with its own set of rules and expiration dates. A simple spreadsheet just couldn't keep up.

Second, the rise of the gig economy caused the number of independent contractors to explode. Suddenly, a company might be paying hundreds, or even thousands, of 1099-eligible individuals. The manual effort needed to collect and validate a tax form from every single one became absolutely overwhelming.

The old methods were like trying to manage a city's traffic with a single stop sign. As the number of cars and intersecting roads grew, the system was bound to fail, leading to gridlock and costly accidents.

Key Technological Breakthroughs

All this pressure created a clear need for a better way, sparking the innovation that led to today's dedicated platforms. These tools brought powerful new technologies that turned a manual headache into a smart, automated process.

Some of the most important breakthroughs were:

- Real-Time Validation: The ability to check a Taxpayer Identification Number (TIN) against the IRS database instantly was a total game-changer. This one feature stops countless errors and potential penalties right at the source.

- Automated Workflows: Modern portals automate the entire tax form process. They handle everything from sending the initial request and guiding the vendor to the right form, all the way to sending reminders when it's time to renew.

- Global Form Management: The best systems were built to tackle the maze of international tax rules, supporting dozens of different forms for various countries.

The scale of this change is pretty staggering. For example, by 2023, a leading platform like Tipalti was able to collect tax IDs and documents for 50 countries, using over 4,000 unique validation rules to get it right. You can learn more about how these platforms scale to meet global demand.

This evolution shows that a vendor tax form portal is no longer a nice-to-have; it's a core part of doing business. With governments pushing for digital tax processes, like the UK's Making Tax Digital for Self Assessment initiative, having a solid vendor portal is simply essential for any company operating in today's connected world.

Must-Have Features for Your Vendor Portal

When you start shopping for a vendor tax form collection portal, you'll see a huge range of options. Some are little more than digital filing cabinets, while others are powerful automation tools that can transform your payables process. To get the security and efficiency your business deserves, you have to know which features are truly essential.

Think of it like buying a car. The base model will get you from point A to B, sure. But for real peace of mind and a smooth ride, you want the upgrades—the automatic emergency braking, the blind-spot monitoring. The same goes for your vendor portal. The right features are what will protect you from costly compliance mistakes and free your team from tedious administrative work.

Let’s walk through the non-negotiables your portal absolutely must have.

Secure Self-Service Onboarding

The bedrock of any great vendor portal is a secure, simple onboarding experience for your suppliers. This means vendors should be able to get themselves set up in your system without having to email you sensitive documents or call your team for step-by-step help. A self-service portal puts them in the driver's seat.

This is a huge deal for a few reasons:

- It cuts down your team's workload. Instead of chasing down vendors and manually keying in their data, your team can focus on more important things.

- It means cleaner data. When vendors enter their own information, you dramatically reduce the chances of typos and other data entry errors on your end.

- It's way more secure. Having vendors submit their W-9s through an encrypted portal is infinitely safer than having them float around in email inboxes.

Getting this first step right sets the tone for a smooth, professional relationship. For a deeper dive into making a great first impression, our guide on vendor onboarding software has you covered.

Automated W-9 and W-8 Form Collection

The whole point of a vendor tax portal is to collect tax forms, right? But the best systems don't just collect them—they do it intelligently. Your portal needs to be smart enough to guide vendors to the correct form.

Based on a few simple questions, like whether they are a U.S. person or business, the system should automatically present them with either a W-9 or the right W-8 series form. Leaving it up to your vendors to figure this out is a recipe for mistakes. This simple bit of automation is your first line of defense in tax compliance.

Real-Time TIN Matching

This feature is a total game-changer and, frankly, a must-have. Real-time Taxpayer Identification Number (TIN) matching is exactly what it sounds like: the portal instantly checks the vendor’s name and TIN against the IRS database before the form is even submitted.

Think about it. Imagine you've been paying a new contractor for six months, only to find out at year-end that their W-9 had the wrong tax ID. Now you're facing backup withholding headaches, potential penalties, and a messy cleanup job.

Real-time TIN matching prevents these problems from ever happening. It's like having a bouncer at the door of your accounting system who checks every ID, making sure only valid, correct information gets inside. This single check can save you from massive headaches and financial penalties down the road.

Secure Document Storage with Audit Trails

So, you've collected the form. Now what? A top-tier portal acts as a secure vault for all your vendor tax documents. This isn't just a folder on a shared drive; we're talking about a centralized repository protected with serious encryption, both when the data is moving and when it's sitting on a server.

But secure storage is only half the story. The system absolutely must keep a detailed audit trail. This means every single action is logged—who uploaded a document, who viewed it, when it was updated, and by whom. If you ever face an audit, this log provides an ironclad record of your due diligence.

Automated Alerts and Expiration Tracking

Tax compliance is not a "set it and forget it" activity. Some forms, especially the W-8 series for foreign vendors, expire. Trying to track these dates manually on a spreadsheet is a disaster waiting to happen. It's tedious, error-prone, and something will inevitably slip through the cracks.

A modern portal handles this for you. It should constantly monitor the validity of every form and automatically send reminder emails—to both you and your vendor—long before a form is about to expire. This proactive approach ensures you're always covered with current, valid tax forms, turning a major compliance risk into a fully automated process.

When you start working with vendors, you quickly realize that tax compliance isn't a one-size-fits-all deal. The rules for a supplier in your own country are completely different from those for a contractor overseas. Getting this right from the start is one of the most important things you can do for your accounts payable process.

It’s a bit like navigating with two different kinds of maps. For your U.S.-based vendors, you're using a detailed road map of state and federal highways. But for your international partners, you need a world atlas. The symbols are different, the languages change, and you have to worry about border crossings. If you use the wrong map, you’ll get lost—and in the tax world, getting lost often means facing some hefty penalties.

The Role of Domestic Tax Forms

For any vendor you work with inside the United States, your go-to document is the IRS Form W-9, Request for Taxpayer Identification Number and Certification. Its job is pretty simple but absolutely critical. The W-9 is how you officially get a vendor's legal name, address, and, most importantly, their Taxpayer Identification Number (TIN). This is either a Social Security Number (SSN) for an individual or an Employer Identification Number (EIN) for a business.

Having a valid W-9 on file is the key to getting your year-end reporting right. It gives you all the information you need to issue a Form 1099-NEC or 1099-MISC, which tells the IRS how much you paid that vendor. If you don't have a correct W-9, you could face IRS penalties. Even worse, you might have to start backup withholding, which means holding back a chunk of their payments to send directly to the IRS.

A vendor tax form collection portal pretty much eliminates this headache. It makes collecting a W-9 a standard, automated part of bringing on any new vendor, so you know you have the right info from day one.

Understanding International Tax Forms

Things get a lot more complicated when you start paying vendors outside the U.S. Instead of a W-9, you'll need a form from the W-8 series. These forms, like the W-8BEN for individuals or the W-8BEN-E for businesses, have a totally different purpose. They're used to certify that your vendor is a foreign person or entity and to claim any tax treaty benefits that might apply.

This is a classic tripwire for many businesses. As companies grow and work with people globally, keeping up with different tax rules is a huge challenge. A good source of expert tax and accounting solutions can be a lifesaver, helping you navigate operations in different countries without running into trouble.

Unlike a W-9, W-8 forms expire—usually every three years—and have to be renewed. If you fail to collect the right W-8 form or don't get it renewed in time, you could be on the hook to withhold a flat 30% of their payments and send it to the IRS.

This is something tax pros always stress: get the right paperwork at the very beginning of the relationship. Businesses have to figure out which forms they need, what withholding rates to apply, and when everything is due. You can find more practical advice about these vendor compliance essentials on pkfod.com.

This is where a solid vendor tax form portal really shines. It automates this whole complex maze. The system asks vendors a few simple questions and then guides them to the exact form they need to fill out. You get the right document every single time, without having to become a global tax expert yourself.

Putting a Vendor Tax Form Collection Portal into Action

Switching over to a dedicated portal for collecting vendor tax forms might sound like a huge undertaking, but it doesn't have to be. When you break it down into a few clear phases, the whole process becomes much more manageable. Think of it less as a total system overhaul and more as a smart, step-by-step upgrade to how you already handle your accounts payable.

The best place to start is by taking an honest look at your current process. Where are things getting stuck? Are you constantly chasing down forms, dealing with incorrect TINs, or wasting hours on manual follow-ups? Identifying these specific pain points is what builds the case for making a change and gives you a clear roadmap for the entire project.

Phase 1: Planning and Picking Your Platform

Before you can start building, you need a solid blueprint. This first phase is all about figuring out exactly what your business needs and then finding the right tool for the job. Don't be tempted to rush this part. The right portal will feel like it was made for you, while the wrong one can just swap old headaches for new ones.

Here’s what to focus on first:

- Map Out Your Current Process: Get a clear picture of how you onboard vendors and collect tax forms right now. Document every step. This will shine a light on where the biggest delays and most common errors happen, showing you exactly where you can improve.

- Define What You Need: Make a non-negotiable checklist. Do you need to handle W-8 forms for international vendors? Is real-time TIN validation a must-have? Does it absolutely have to integrate with your current accounting software?

- Find the Right Partner: With your list in hand, start researching portal solutions. Sit through a few demos, ask tough questions about security and customer support, and choose a provider that feels like a true partner—one who understands your business and can grow with you.

Remember, a successful rollout is about people as much as it is about technology. The slickest portal will fall flat if your team isn't comfortable using it and your vendors don't know why you're making the change.

Phase 2: Setup and Communication

Once you’ve picked your portal, it’s time to get it ready for prime time. This phase is about configuring the system to work for you and letting everyone know what’s coming. A big part of this is making sure the initial setup is as painless as possible. If you want to dive deeper into this, our guide on strategies for https://www.superdocu.com/en/blog/onboarding-vendor/ is a great resource.

Here’s what this stage involves:

- Plan Your Data Migration: How will you get your existing vendor information into the new system? You could do a bulk import or decide it’s easier to have all vendors submit fresh forms through the portal.

- Configure the System: This is where you make the portal your own. Set up your automated reminder schedules, customize the email templates, and add your company’s logo and branding.

- Create a Communication Plan: Draft clear, simple announcements for your vendors. Explain how the new portal makes things easier and more secure for them, and give them straightforward instructions on how to get started.

Phase 3: Training, Launch, and Beyond

This is the home stretch—it’s time to go live. With a well-trained team and informed vendors, you can launch your new portal with confidence. But the job isn't done once you flip the switch. Keeping an eye on how things are going ensures you get the most out of your new tool.

To finish strong, make sure you:

- Train Your Internal Team: Get your AP and procurement teams fully up to speed. They need to know how to navigate the dashboard, manage submissions, and run reports without any guesswork.

- Launch and Support: Officially launch the portal and send out your announcements. Make sure your team is ready to field questions and help vendors who might need a little extra guidance.

- Monitor and Fine-Tune: After the launch, track your progress. Are vendors getting their forms in faster? Are there fewer errors? Use this real-world feedback to make small adjustments and truly perfect your new, simplified process.

Got Questions About Vendor Portals? We’ve Got Answers.

Switching to any new system, especially one that handles something as important as tax forms, is bound to bring up a few questions. That's completely normal. Moving from a manual process to a vendor tax form collection portal is a big leap forward, so let's tackle the common what-ifs right away.

We’ve pulled together the questions we hear most often from businesses just like yours. The goal here is simple: give you straight, clear answers so you can see how this kind of tool works in the real world.

How Secure Is My Vendor's Data, Really?

This is usually the first question, and it’s the right one to ask. When you're dealing with Social Security Numbers and tax IDs, security is everything. Portals are built from the ground up with security in mind, making them worlds safer than shooting sensitive documents back and forth over email.

Any reputable platform will have layers of protection for vendor information. Here’s what that typically looks like:

- Encryption: Think of this as a digital seal. Data is scrambled both while it's being uploaded (in transit) and while it's stored on the server (at rest).

- Secure Access Controls: You control who sees what. Only authorized people on your team can access the information, and you can set different permission levels for an extra layer of security.

- Regular Audits: The best platforms are regularly tested by outside experts to prove they meet tough security standards, like SOC 2 compliance.

It’s like the difference between a bank vault and a mailbox. Your email is the mailbox—easy to access, but not built for valuables. A dedicated portal is the bank vault, designed for one purpose: to keep what's inside locked down tight.

What If a Vendor Just Won't Use the Portal?

This is a common worry, but in practice, it’s rarely a problem. Most of your vendors will actually prefer a system that makes their life easier and keeps their information safer. The trick is all in how you introduce it.

When you roll it out, frame it around the benefits for them. Explain that it’s faster, gives them instant confirmation that their form is correct, and is far more secure than email. For that rare vendor who is truly tech-averse, you’re not stuck. Most portals let an admin manually upload a form on their behalf, so you still get that single, secure, and centralized hub for all your documents.

While a few vendors might hesitate at first, we see that over 95% get on board without a fuss once they realize how simple and safe it is. Convenience is a powerful motivator.

Can a Portal Handle All My Different Kinds of Vendors?

Yes, absolutely. A good portal is designed to handle the complexity of a modern supplier base. It doesn’t matter if you're paying a freelance photographer, a local small business, or a large international partner.

The system uses a guided process to ask the right questions, automatically directing each vendor to the exact form they need. Whether it's a W-9 for a US-based contractor or one of the various W-8 forms for a foreign entity, the portal ensures you collect the right document every single time.

Ready to stop chasing paperwork and start automating your compliance? Superdocu provides a secure, user-friendly platform to collect and manage all your vendor tax forms effortlessly. Discover how Superdocu can transform your vendor onboarding process today.