Think of a Know Your Business (KYB) tool as an automated background check for companies you want to work with. It's designed to verify a business's legitimacy in minutes, not weeks. Instead of digging through records manually, these platforms answer the big questions for you: Is this company real? Who's actually in charge? And, critically, Are they on any watchlists?

Understanding the Role of a KYB Tool

Let's say you're about to sign a contract with a new supplier or bring on a major corporate client. How can you be sure they are who they say they are? In an economy where fraud is getting more sophisticated by the day, a quick search and a gut feeling just don’t cut it anymore. This is exactly where a KYB tool steps in.

At its heart, a KYB tool is your digital detective. It automates the messy, complicated process of business verification by checking information against official government registries, global watchlists, and other reliable data sources. The whole point is to build a clear, accurate picture of any business you interact with.

From Manual Effort to Automated Assurance

Not long ago, this whole process—often called Due Diligence—was a huge manual slog. Teams of analysts would spend hours, even days, chasing down documents, searching separate databases, and trying to map out complicated corporate structures. It was slow, expensive, and easy to make a mistake.

A modern kyb tool completely changes the game. By automating how data is gathered and analyzed, it gives you immediate answers to:

- Verify Legitimacy: Is the business legally registered and in good standing?

- Identify Ownership: Who are the Ultimate Beneficial Owners (UBOs)—the actual people pulling the strings?

- Screen for Risks: Does the company or its owners show up on sanctions lists, as politically exposed persons, or in negative news?

- Maintain Compliance: Are you meeting your legal requirements for things like Anti-Money Laundering (AML)?

This automation is especially crucial when vetting new partners, something we cover in more detail in our guide on choosing a supplier due diligence tool.

The core function of a KYB platform is to replace ambiguity with certainty. It provides the verifiable data needed to make informed, risk-averse decisions quickly and efficiently.

It's no surprise that the demand for these tools is exploding. The global E-KYB market was valued at USD 0.157 billion in 2024 and is expected to reach USD 0.44 billion by 2033, mostly because businesses have to fight fraud and comply with strict AML rules. By automating these checks, a KYB tool does more than just save you time—it builds a solid foundation of trust and security for every business relationship you have.

The Hidden Dangers of Manual Business Verification

Picture this: your team is ready to onboard a fantastic new corporate client. The initial steps seem straightforward enough—a few Google searches, a quick look at the national business registry, and asking for scanned copies of their incorporation papers. On the surface, it all looks good. But this old-school manual approach is full of dangerous blind spots.

This process isn't just slow; it's a genuine threat. Your team burns hours on tedious administrative work that a proper KYB tool could knock out in seconds. Even worse, it hinges entirely on human accuracy, which opens the door for someone to miss a critical red flag or get tangled up in a complex ownership web.

For instance, a compliance officer might confirm a company's registration but completely miss that a key director is tied to a shell company in a high-risk country. This is exactly the kind of move sophisticated criminals use to launder money and hide who they really are.

The Shell Company Trap

Let's be clear: professional fraudsters don't operate under one easy-to-spot business name. They weave intricate, layered networks of shell companies and trusts, all designed to hide the true Ultimate Beneficial Owner (UBO). A manual check, no matter how thorough, will almost always fail to untangle this mess.

Here’s how it usually plays out:

- The Target: Your company starts the onboarding process for "Innovate Global Ltd." They have a polished website and look completely legitimate.

- The Manual Check: Your team confirms their local registration and reviews the director info they provided. Everything seems to line up.

- The Hidden Reality: What you don't see is that "Innovate Global Ltd." is owned by "Apex Holdings," an offshore entity. And Apex Holdings is controlled by someone on an international sanctions list.

A manual verification process is like trying to solve a maze by only looking at the entrance. You see the first step, but you have no visibility into the complex, interconnected paths that lie beyond, where the real risks are hidden.

The High Cost of Getting It Wrong

Missing these red flags isn't just a minor slip-up. It can expose your business to some seriously painful consequences, well beyond just a bad partnership. The fallout can be devastating, leading to massive regulatory fines and doing permanent damage to your brand's reputation.

The root of the problem is that manual checks are reactive and never give you the full picture. They rely on disconnected, often outdated sources of information and simply can't connect the dots. Even just reviewing the paperwork is a huge challenge. While a skilled team can improve their workflow with dedicated document verification software, that alone doesn't solve the puzzle of hidden ownership structures.

In the end, sticking with manual verification isn't just inefficient anymore—it's practically rolling out the welcome mat for fraud, financial loss, and major compliance headaches.

What To Look For in a Modern KYB Tool

To really get a handle on fraud and stay on the right side of regulations, a KYB tool needs to do more than just run a few basic searches. It needs a collection of features that work in concert to give you a clear, complete, and up-to-date picture of every business you work with.

Think of these features less like a checklist and more like interlocking pieces of armor. Each one plays a unique role, from gathering initial data to keeping an eye on risks long after onboarding. Knowing what to look for is the first step toward picking a solution that actually makes your business safer and more efficient.

Automated Business Data Extraction

The foundation of any good KYB tool is its ability to automatically pull and check data straight from official sources. This means it connects directly to government business registries and legal databases worldwide, grabbing essentials like registration numbers, legal status, and official addresses in real-time.

This automation gets rid of the painstaking, error-prone task of manually digging up and copying this information. It ensures the data you build on is accurate and legitimate from the very start.

Ultimate Beneficial Owner (UBO) Mapping

It’s one thing to verify a company’s existence, but it’s another thing entirely to know who really owns and controls it. This is where UBO mapping is critical. A top-tier KYB tool can unravel even the most confusing corporate webs, cutting through shell companies and holding entities to pinpoint the actual people at the top.

This is your single best defense against bad actors trying to hide behind anonymous corporate structures. By creating a clear, visual map of the ownership chain, it makes sure you know exactly who you’re getting into business with—a non-negotiable part of AML compliance.

Many powerful KYB tools also use open-source intelligence (OSINT) to find public information about businesses and their owners. To learn more about this, check out this comprehensive guide on OSINT background checking.

A KYB tool without strong UBO mapping is like a security camera pointed only at the front door. It shows you someone is there, but it can’t tell you who they are or what they’re planning.

Real-Time Screening and Monitoring

After you’ve verified a business and its owners, the KYB tool has to screen them against global watchlists. This involves checking for any red flags on:

- Sanctions Lists: Pinpointing individuals or companies restricted by governments.

- Politically Exposed Persons (PEPs) Lists: Flagging individuals in prominent public roles who might carry a higher risk.

- Adverse Media: Scanning for negative news stories tied to financial crime, fraud, or other illegal activities.

But here’s the crucial part: this can’t be a one-and-done check. Continuous monitoring is an absolute must-have. It sends you instant alerts if a business partner’s risk status changes down the road. If a director gets added to a sanctions list six months after you’ve onboarded them, you need to know about it right away.

This proactive approach is what turns a simple verification tool into a genuine risk management platform. And businesses are catching on—spending on KYB tools is expected to jump by 140% by 2029, hitting a massive $22 billion.

How Different Industries Use KYB Tools

While banking and finance were the early adopters, the need for solid business verification has spread to nearly every corner of the economy. A modern KYB tool isn't just for banks anymore; it's a flexible asset that boosts security and smooths out operations, no matter what you sell.

Companies from sprawling online marketplaces to B2B software providers are all waking up to the same reality: you have to know who you're doing business with. This shift is a big reason why the global KYB market is expected to hit $712.87 million by 2030, a trend explored in Silt's 2024 trends report.

E-commerce and Online Marketplaces

In e-commerce, your reputation is your currency. Just one bad seller dealing in counterfeit goods or scamming customers can poison the well for everyone and cause lasting damage to your brand. KYB tools act as a crucial gatekeeper.

Before a new seller gets the keys to their virtual storefront, the platform can use a KYB tool to:

- Verify Business Registration: Is this a real, registered company?

- Check for a Shady Past: Screen the business and its owners for red flags like fraud or criminal records.

- Confirm Bank Details: Do the payment details actually belong to the verified business?

This kind of automated check protects shoppers, keeps the platform trustworthy, and helps marketplaces grow without letting the bad guys in. To handle this at scale, many platforms rely on a dedicated vendor onboarding automation platform to keep things running smoothly.

B2B SaaS Companies

Software-as-a-Service (SaaS) providers have their own set of headaches. A fake company could sign up for a pricey subscription using stolen credit card details, or a legitimate-looking client could turn out to be a major credit risk.

A KYB tool helps SaaS companies sidestep these problems by quickly confirming a new client's identity and financial stability. This upfront check ensures the business is who it says it is, which drastically cuts down on payment fraud and frustrating chargebacks. It's an absolute must for companies that offer enterprise-level plans.

By building KYB checks right into their signup process, SaaS businesses can approve new customers with confidence. It’s the perfect way to balance a smooth, welcoming experience with rock-solid financial security.

Lending and FinTech Platforms

In the world of business lending, you need to be both fast and right. Lenders and FinTech innovators use KYB tools to run deep background checks on loan applicants in a fraction of the time it used to take. Forget spending days chasing down documents—they can now pull a complete risk profile in minutes.

With just a few clicks, they can confirm a company is legitimate, see if it’s on any sanctions lists, and map out its ownership structure. This speed doesn't just get loans approved faster; it also helps lenders stay on the right side of strict anti-money laundering (AML) rules, creating a safer financial system for everyone.

Choosing the Right KYB Tool for Your Business

Picking the right KYB tool isn't just about ticking boxes on a feature list. It’s about finding a platform that fits into how your business actually works, grows with you, and delivers data you can genuinely trust.

Think of it this way: you wouldn't use a basic tourist map to navigate a cross-country road trip. You'd want a GPS with live traffic, alternate routes, and points of interest. Your KYB tool should offer that same level of smart, integrated support for your business verification journey.

Define Your Data and Coverage Needs

First things first, where in the world are you doing business? If you only work with domestic companies, a tool with strong local registry connections is fine. But if you’re an online marketplace with global sellers, you’ll need a solution with broad international reach.

Before you even start looking at vendors, get your team together and answer a few key questions:

- Where do we operate? Make sure any tool you consider has direct access to official business registries in those specific countries.

- How deep do we need to dig? Is simply confirming a company exists enough, or do you need to unravel complex ownership structures to find the UBO and screen for negative news?

- What's our appetite for risk? If you're in a high-risk industry like fintech or gaming, you'll need much more detailed data and ongoing monitoring than a B2B SaaS company might.

Nailing down these answers will immediately help you cut through the noise and eliminate options that simply aren’t a good fit.

A KYB tool is only as good as its data. Prioritizing a provider with accurate, comprehensive, and up-to-date information sources is the most critical decision you'll make in this process.

Evaluate Technical Integration and User Experience

Let's be honest—a powerful tool that no one on your team can figure out is a useless tool. The platform needs to work for everyone, from your engineers to your compliance analysts. An API-first approach is non-negotiable; it allows you to build verification checks directly into your onboarding flow, CRM, or other internal systems.

At the same time, the user interface (UI) has to be intuitive for the people using it every day. Your compliance team should be able to manage cases, investigate alerts, and generate reports without having to file a ticket with the IT department. Look for a clean dashboard, easy-to-understand risk scores, and clear visual maps of company ownership.

Scrutinize Scalability and Pricing Models

Finally, think about where your business is headed. A solution that handles 10 verifications a month might grind to a halt—or get incredibly expensive—when you hit 100 or 1,000. Ask vendors how their systems perform under pressure and ensure their infrastructure can keep up with your growth.

Pay close attention to the price tag, too. Some providers charge per check, others have monthly subscriptions, and many have hidden fees for premium data or extra API calls. A transparent, predictable pricing model is crucial. It ensures your KYB tool remains a valuable asset, not a budget black hole, as your business expands.

How to Build Automated KYB Workflows

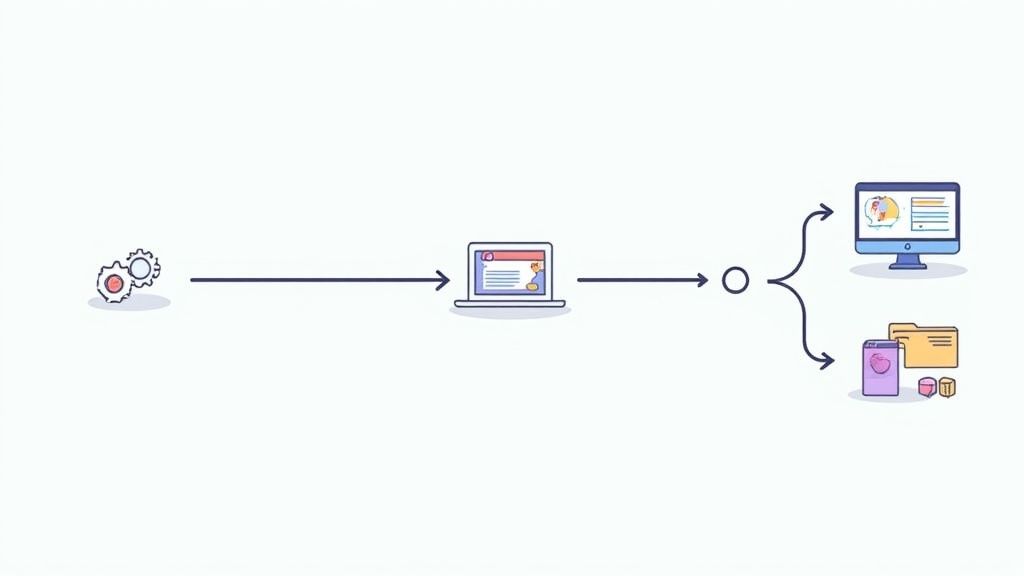

The real power of a KYB tool isn’t just in doing a quick, one-time check. It’s about building a repeatable, automated system that manages risk from the moment a new business applies all the way through your ongoing relationship. This is how you turn compliance from a box-ticking exercise into a real operational strength.

Modern tools are built to make this incredibly simple. The idea is to create a step-by-step workflow that kicks off the second a new business enters your pipeline. This way, you can be certain that every single entity goes through the same strict, documented process without anyone on your team having to lift a finger.

Start with Smart Templates

Instead of reinventing the wheel, a great starting point is to use pre-built templates. Platforms like Superdocu offer these right out of the box, with workflows designed for common tasks like vendor onboarding or new client due diligence. All the core steps are usually already mapped out for you.

From there, you can tweak them to fit your exact needs:

- Request Specific Documents: Automatically prompt businesses for their articles of incorporation, tax IDs, or proof of address.

- Define Verification Steps: Set rules for what information gets pulled from documents and cross-referenced with official registries.

- Automate Reminders: If a business takes a while to submit their documents, the system can send out friendly, automated follow-ups so your team doesn't have to.

Taking this template-first approach can slash your setup time by over 70%. You can get a solid KYB process up and running in a matter of hours, not weeks.

Use a Centralized Validation Dashboard

Once a business submits its information, it all flows into one central dashboard. This gives your team a single, clear view of every application in the pipeline.

This centralized hub is your audit trail. It shows precisely who was checked, when the checks happened, and what the outcomes were.

Think of a validation dashboard as your team's command center. It cuts through the noise, ensures everyone is on the same page, and makes it dead simple to manage cases or pull records for an audit.

When you connect this dashboard to your other tools, like a CRM, you get a truly seamless, end-to-end automated system.

Got Questions About KYB? We’ve Got Answers.

Still have a few questions about how KYB tools actually work in practice? Let's clear up some of the most common ones we hear.

What’s the Real Difference Between KYC and KYB?

Think of it this way: Know Your Customer (KYC) is all about verifying an individual. Are they who they say they are?

Know Your Business (KYB), on the other hand, zooms out to verify an entire business entity. We’re talking about confirming its legal registration, untangling its ownership structure, and identifying the key people pulling the strings. Both are crucial for staying compliant, but they tackle different pieces of the risk puzzle.

How Fast Is an Automated KYB Check, Really?

This is where the magic happens. A manual check can drag on for days, sometimes even weeks. An automated KYB tool? It can often deliver a full risk profile in a matter of minutes.

How? The software plugs directly into official business registries and global watchlists in real-time. It completely cuts out the tedious manual work of hunting down documents and cross-checking data.

Are KYB Tools Just for Big-Shot Corporations?

Not anymore. While massive companies absolutely depend on these tools to manage global compliance, they've become essential for small and medium-sized businesses, too.

As fraud gets more sophisticated, SMBs are using KYB software to confidently onboard new clients and check out suppliers. It's a way to protect themselves from serious financial risk without needing to hire a huge compliance department.

Ready to build secure, automated workflows for your business? Superdocu makes it easy to collect and validate business information, ensuring you work only with legitimate partners. Start your free trial today!